Tax Credits & Incentives

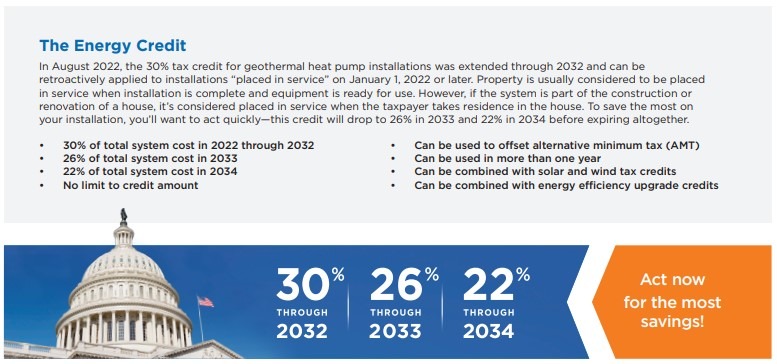

In August 2022, the tax credit for geothermal heat pump installations was extended through 2034. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the tax credit.

The credit has no limit and there’s no limitation on the number of times the credit can be claimed.

US Tax Credits Through 2034

The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. A 30% federal tax credit for residential ground source heat pump installations has been extended through December 31, 2032. The incentive will be lowered to 26% for systems that are installed in 2033 and 22% in 2034, so act quickly to save the most on your installation.

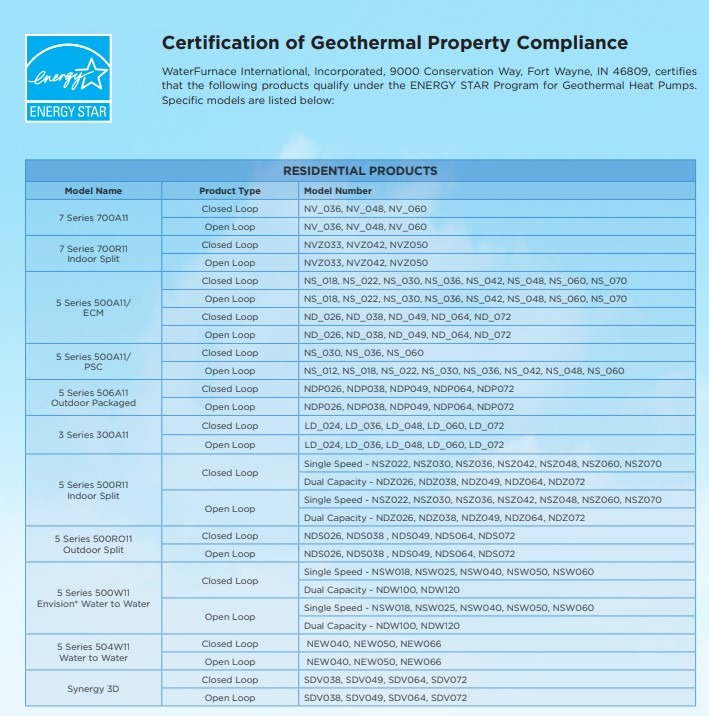

Understanding the Federal Tax Incentives for Geothermal Heat Pumps

Certification of Geothermal Property Compliance

Check For More Local Incentives

In addition to the federal tax credit, some state, local, and utility incentives may be available in your area for even more savings on installing a geothermal heat pump. Check out the Database of State Incentives for Renewables & Efficiency (DSIRE) website to find policies and incentives in your area.

Geothermal: The Smart Choice for Heating & Cooling your Home!

Even without incentives, installing a geo system just makes sense. It’s the only type of system that will pay you back. Most homeowners save more on monthly bills than they pay for the system when installation costs are financed. Any added investment over traditional equipment is usually recovered in just a few years, and many homeowners see a return on investment of 10-20% over the life of the system.

ECS Geothermal

Heating and Cooling with Dirt for Over 25 30 Years!

We are the largest geothermal contractor in Kansas City. We are 100% focused on ground source heat pumps – “All We Do Is Geothermal!”

Phone: 816-532-8334

Contact Us Today for a free consultation.