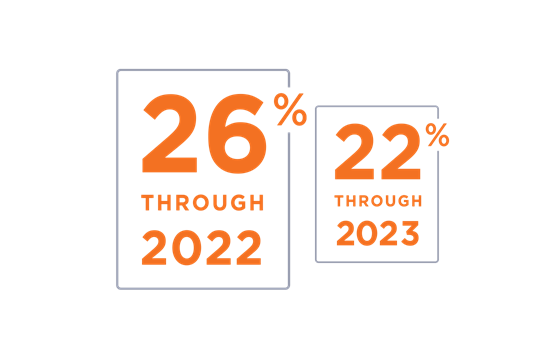

The 26% federal tax credit was extended through 2022 and will drop to 22% in 2023 before expiring altogether, so act now for the most savings!

Tax Liability Savings – Explained

A tax credit is a dollar-for-dollar reduction of the income tax you owe. So in order to qualify for the Federal Tax Credit, you need to have a large enough tax burden to benefit.

Some types of tax credits are refundable. That means you can still receive the full amount of the credit even if the credit exceeds your entire tax bill. For example: If your tax bill is $300, but your refundable tax credit is $1000, you will receive a $700 refund.

The Geothermal Tax Credit, however, is a non-refundable personal tax credit. It can only reduce or eliminate your liability (how much money you owe to the IRS). If your credit is greater than your tax liability, it will not generate a tax refund. For example: If your tax bill is $300, but your non-refundable tax credit is $1000, you will only use $300 of your credit (and will have $700 unused).

Fortunately, the Geothermal Tax Credit allows homeowners to apply their tax credit over multiple years. If your tax burden in 2020 is less than your credit’s full amount, you can carry over the remainder when filing your taxes in 2021. You can even keep doing this as long as the tax credit is active. The Geothermal Tax Credit can offset regular income taxes and even alternative minimum taxes.

For example: Let’s say you purchase a geothermal system for $20,000. That could mean you’re eligible for a $5,200 tax credit. But let’s say you only owe $3,000 in taxes. In this situation, you can simply claim $3,000 in credit this year and $2,200 next year.

To benefit from the Federal Tax Credit, you must owe at least as much in taxes as you would claim for the credit, even if it’s over several years.

If you want to upgrade, contact us and we’ll get you started today so you can take advantage of these savings!

Installing ground source heat pumps since 1993

Phone: 816-532-8334

Contact Us Today for a free consultation.